private placement life insurance uk

The PDF attachment explains what basic life. With the authors.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

At present PPLI policies are more often offered by banks hedge.

. Private placement life insurance PPLI is defined as a flexible premium variable universal life insurance transaction that occurs within a private placement offering. In its most basic form PPLI is a type of permanent cover life insurance offering a broad range of investment options into which the insurance company invests premium. Private placement life insurance is a form of cash value universal life insurance that is offered privately rather than through a public offering.

Private Placement Life Insurance uses the tax advantages of life insurance while getting the monetary gains of hedge funds. It has many advantages but it also has limitations. PPLI is a flexible tax-favored structure designed to hold interests in various asset classes including hedge funds managed accounts both private and public equity limited partnerships.

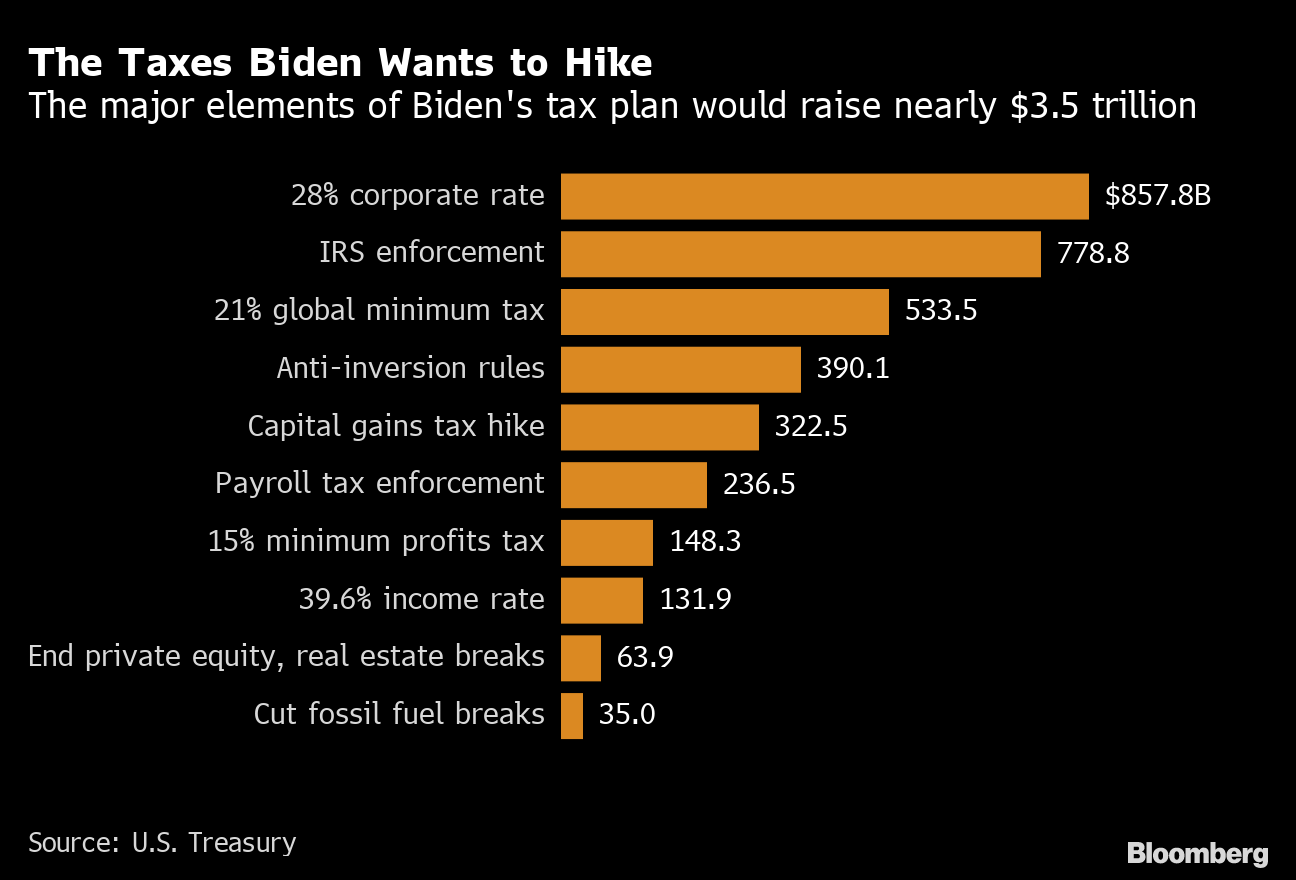

The major elements of Bidens tax plan would raise nearly 35 trillion. Private placement life insurance or ppli is a customized version of variable rate insurance not available to the general public. The product is called private placement life insurance or PPLI and like some other types of life insurance policies a portion of the premiums paid by a policyholder are.

Ad Compare Top 5 Life Insurance Offers Now. But unfavorable rulings and regulations. Winged Keel Group is widely recognized as one of the leading experts in the structuring and administration of Private Placement Life Insurance and Annuity Investment.

The catch is that private placement life insurance requires a significant minimum. PPLI owners and their. Private placement life insurance is a form of cash value.

Following the 2018 US Tax Reform Act the use of private placement life. Private placement life insurance PPLI is a niche solution designed for wealthy individuals who want to invest in hedge funds but avoid the associated high tax rates. It has many advantages but it also has limitations.

Using PPLI as an investment. Vie International offers a portfolio of financial services for individuals and organisations including life insurance health insurance annuities pensions cross-border estate planning group. Private placement life insurance is a very powerful solution for the right wealthy clients in the right circumstances.

PPLI policies are more often offered by banks hedge fund. Democrats aim to raise from 400 billion to 1 trillion by identifying wealthy tax cheats. Private placement life insurance or PPLI is a customized version of variable rate insurance not available to the general public.

Find The Perfect Cover For Your Needs Today. Usually clients buy private placement life insurance more as an investment vehicle than because they actually want life insurance. Private placement life insurance poses a.

Private Placement Life Insurance PPLI. Because of the tax benefits the very. One solution to many of the changes can be to advise the client to invest in a life insurance policy such as a PPLI.

Private placement life insurance is a type of variable universal life VUL insurance1that allows investments contained within the policy to grow with income and capital gains taxes deferred. The administrative costs associated with life insurance. The Taxes Biden Wants to Hike.

Vie International has been a leader in the international private placement life insurance market for over a decade and has used private placement solutions for clients as part of pre-immigration. The underwriting process is both financial and medical includes a physical. All in all private placement life insurance is income tax efficient while providing the owner with tax-free access to the policy cash values.

Private Placement Life Insurance Uk - Ppli Definition Private Placement Life Insurance Abbreviation Finder. Private placement life insurance is a very powerful solution for the right wealthy clients in the right circumstances. Private placement life insurance or PPLI is a customized version of variable rate insurance not available to the general public.

In addition to beefing up HMRC resources and imposing requirements on tax planners to notify HMRC when new planning arrangements are developed in advance of implementing them draft legislation currently under consultation in the UK would go as far as imposing. David Steinegger CEO of Lombard International explains Private Placement Life Insurance. Private placement life insurance With PPLI a thorough underwriting process is required.

Private placement life insurance PPLI is a special type of life insurance that initially originates from the United States.

Swiss Life Companies Enter Into Deferred Prosecution Arrangement For Abusive Private Placement Life Insurance Policies

Ppli Is A Tax Avoidance Insurance Trick That S Only For The Uber Rich Bloomberg

Private Placement Life Insurance Ppli The Who What Where And Why Not And How Much Lake Street Advisors

Top 10 Pros And Cons Of Variable Universal Life Insurance

How To Complete A Private Placement

Private Placement Life Insurance Ppli Considerations For Alternative Investments

What Happens To Your Life Insurance When You Leave A Job Bankrate

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

What Happens If You Lie On Your Life Insurance Application Bankrate

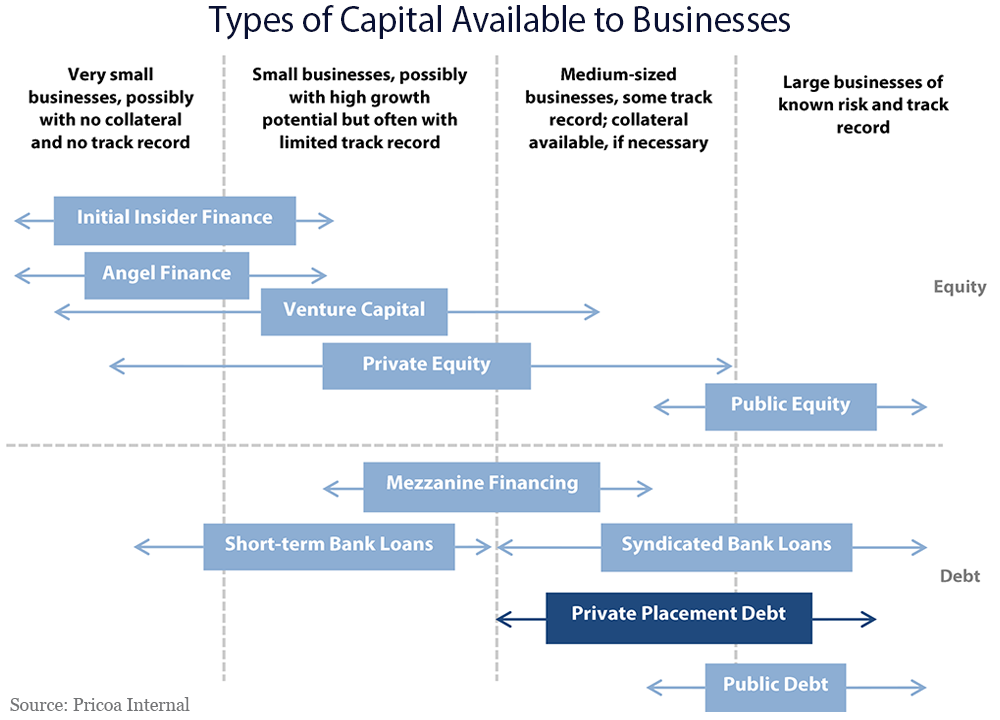

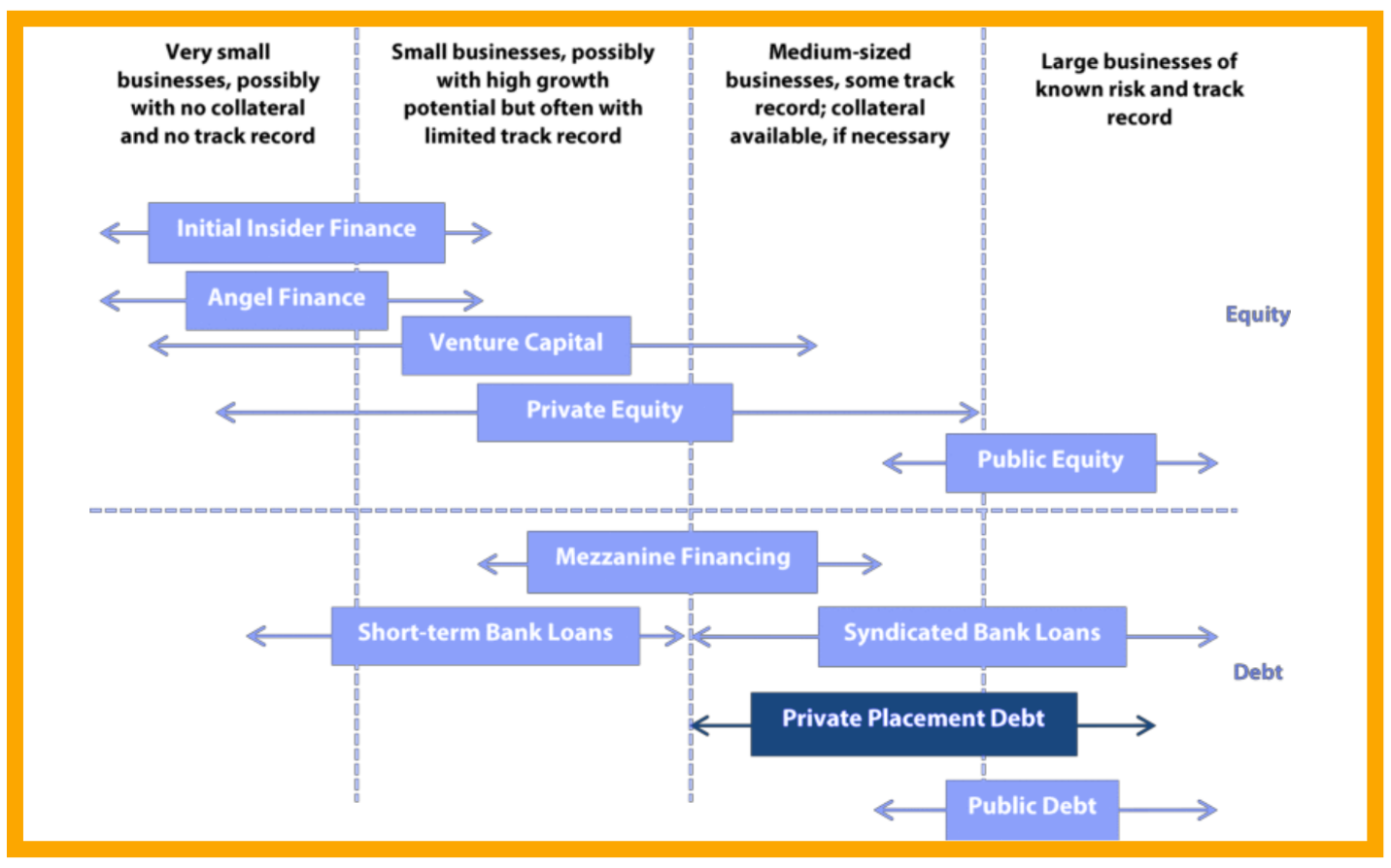

Real World Private Placement Examples And Their Impact On The Businesses

Real World Private Placement Examples And Their Impact On The Businesses

:max_bytes(150000):strip_icc()/dotdash-career-advice-investment-banking-vscorporate-finance-Final-6c88b378459d43fabfc4474e194bcb29.jpg)

Investment Banking Vs Corporate Finance What S The Difference

High Net Worth Life Insurance Solutions Deutsche Bank Wealth

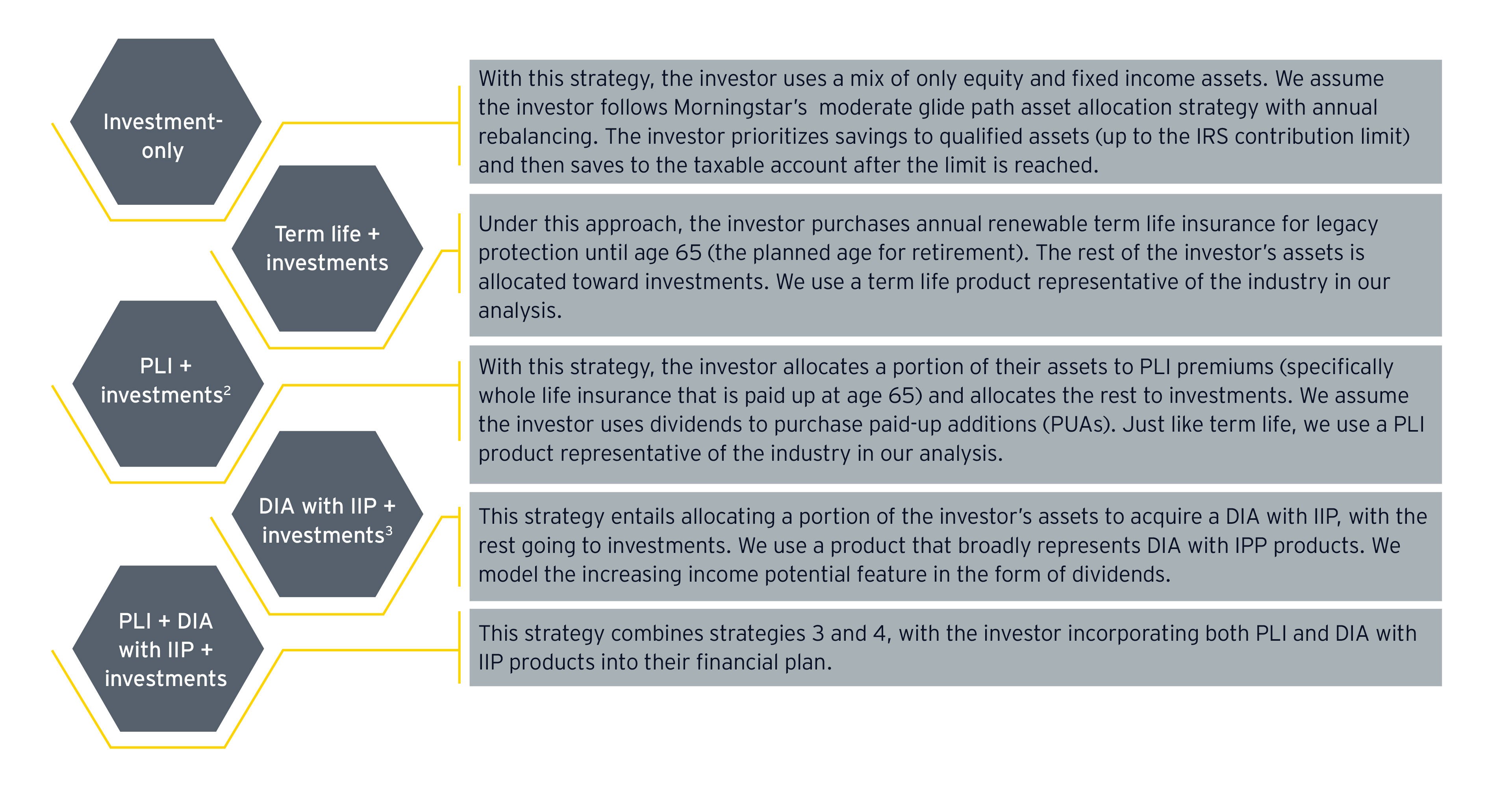

How Insurance And Investments Can Improve Financial Wellness Ey Us

Real Estate Private Equity Career Guide

Real Estate Private Equity Career Guide